Pennsylvania Catalyst Loan Fund Created

One week after Pennsylvania Governor Tom Wolf announced $268 million in American Rescue Plan funding to assist small businesses, the Chester County Economic Development Council (CCEDC) is detailing how those funds will benefit small businesses in eight counties across eastern Pennsylvania.

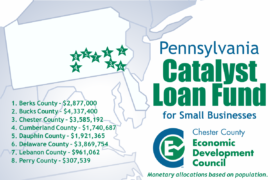

Almost $20 million of that funding is devoted to eastern Pennsylvania’s new regional loan fund, which CCEDC is administering. Called the Pennsylvania Catalyst Loan Fund, CCEDC received the highest allocation of funding of all Certified Economic Development Organizations in the state. CCEDC’s Pennsylvania Catalyst Loans will be underwritten and approved by CCEDC for all business applicants in Berks County, Bucks County, Chester County, Cumberland County, Dauphin County, Delaware County, Lebanon County and Perry County.

The Pennsylvania Catalyst Loan Fund features fixed interest rates that are below prevailing bank interest rates. Loans typically range from $50,000 to $500,000, and the loan application process is expected to begin November 1, 2022. Business owners should begin to prepare necessary documentation including a business plan, financial projections, market research, major sales targets, accountant and attorney information.

“What’s really exciting about this loan program is that we are able to help businesses and industries we have not been able to serve before, and on top of that, we can also provide direct technical assistance to help borrowers qualify for financing,” said Chris McHenry, CCEDC Vice President of Development Finance. “Previously, we have not been able to assist with loans for working capital and inventory, or lend to the retail sector unless they owned their building. This will be a real help to main street businesses that wouldn’t normally qualify for traditional loans.”

“We are delighted to be awarded these funds through the Pennsylvania Small Business Credit Initiative and are inspired by the collaboration with our colleagues in Southeastern and Central Pennsylvania, benefitting the entire region,” said Gary Smith, CCEDC President and CEO. “This award will allow us, in partnership with five economic development partners covering seven other counties, to make critical investments in local small businesses of all kinds as they continue to grow and recover from the pandemic and its economic impacts. In particular, expanding credit access to socially and economically disadvantaged groups is a priority of our organization. We are pleased that this program, which will offer below-market, fixed interest rate small business loans, enables us to make those investments on an even larger scale.”

Business situations that might benefit include a store that wants to expand by purchasing inventory, buying equipment like shelving, and hiring more workers. A return on that investment can take many months, and a Pennsylvania Catalyst Loan can help bridge that gap. Working capital funds can also be spent on items like vehicle upgrades, advertising, building supplies and renovations. McHenry says, “We are looking for business owners with either a positive operating history or entrepreneurs with strong business plans. It takes documentation and research to demonstrate that, and the time to start is now.”

Pennsylvania Catalyst Loans require a match with a partner lender, with borrowers providing equity up to 20%. Loan terms are up to five years. For questions and initial assistance, each business should contact their county’s certified economic development organization:

- Berks County: Greater Berks Development Fund – 610-376-6739

- Bucks County: Bucks County Economic Development Corporation – 215-348-9031

- Chester County: Chester County Economic Development Council – 610-458-5700

- Cumberland County: Capital Region Economic Development Corporation – 717-232-4099

- Dauphin County: Capital Region Economic Development Corporation – 717-232-4099

- Delaware County: Delaware County Economic Development Oversight Board – 610-566-2225

- Lebanon County: Lebanon Valley Economic Development Corporation – 717-274-3180

- Perry County: Capital Region Economic Development Corporation – 717-232-4099