Expert Insight on Interest Rates, Inflation and Personal Investment in 2024

The Chester County Economic Development Council’s Annual Economic Outlook is the longest-running event of its kind in the region, and today it celebrated 20 years with an all-star lineup of analysts that attracted an audience of more than 150 leading business executives and community leaders.

“This time in 2024, compared to this time in 2023: What a 180! It’s a whole different ballgame,” said nationally renowned wealth advisor and CEO of Key Financial, Inc. Patti Brennan, CFP, who is a CNBC commentator and was named a Hall of Fame Advisor by Dow Jones & Company’s Barron’s. “The recession didn’t happen in 2023, but will it happen in 2024? I’m not predicting one. But the presidential election is creating uncertainty regardless of who wins, and the markets don’t like uncertainty. I do not believe the markets are going to go down for the year, but everyone should be prepared for higher volatility throughout the year. If you think you will need money, set it aside. That way if the worst happens, it will begin to recover post-election as November and December unfold.”

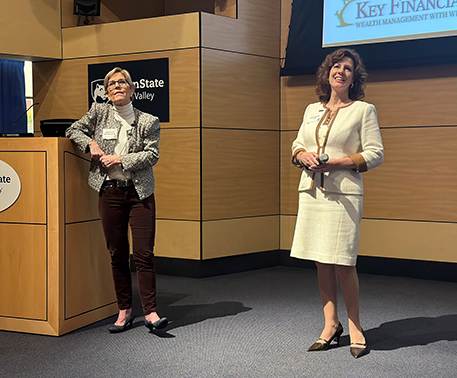

Brennan was joined by economic specialist Dianne P. Manges, CFA, Director/Senior Investment Advisor for Truist Foundations & Endowments Specialty Practice, as the pair shared expert insights on the local, national and global economies during CCEDC’s 20th Annual Economic Outlook on Wednesday at Penn State Great Valley.

“Uncertainty was the prevailing theme of 2023, and that concept of crosscurrents is very much still relevant starting out in 2024,” said Manges. “While we don’t expect a recession, we do expect a growth rate below the 20-year average – perhaps around 1%. Those industries that can benefit from AI and other advances in technology will fare best – and may even thrive – while smaller industries will struggle. In 2024, larger companies will also continue to weather the effects of higher interest rates better than smaller industries, which are more impacted by high-interest financing.”

Weighing in on interest rates, Brennan predicted at least one interest rate cut by summer and likely two more cuts in 2024. As for mortgage rates, Brennan said, “Mortgage rates will begin to come down in 2024, settling in at 5% to 6%, and that’s when home buying activity will perk up again, probably in 2025.” Brennan anticipates that inflation will continue to decrease in 2024, “but as we all know, the impact takes much more time to reach the consumer. That’s why your groceries continue to be expensive and will continue so in 2024.”

So what should your investment strategy be? Manges notes, “In 2022, all markets were down double digits and the temptation in 2023 was to say, ‘I don’t want to go through that again.’ However, last year a well-balanced portfolio gave double-digit returns! Yes, these are outsized numbers, and rolling returns for the last 3, 5 and 20 years show a hearty single-digit return is more reasonable. The point is that whether you’re a personal or business investor, my advice is to peel your fingers off the large amounts of cash you’re sitting on because you don’t want to miss out on opportunity.”

Manges continues, “Risk is a big part of the discussion for 2024. With the Fed projecting rate cuts 3 times or 75 basis points – but the markets predicting double that – the gap is too big and the risk in that environment can be high. With this in mind, for my clients, which are large institutions including nonprofits, our investment strategy is focusing on larger U.S.-based companies as opposed to mid-cap, small-cap or international. When it comes to mid-cap and small-cap, over the long term they tend to outperform large-cap, but with it comes more volatility and more risk that I’m not willing to take right now.”

As for Chester County, Brennan says, “We are the sweet spot of Pennsylvania – and even nationally – with unemployment much lower than national levels and the housing market much more resilient. It is truly the land of opportunity so we look not at whether things are good or bad, but whether they’re better or worse. In Chester County there’s every reason to think it will get better based on the data.”

CCEDC continues its 2024 programming with the 12th Annual SEI Energy Briefing on February 15, presented by CCEDC’s Smart Energy Initiative of Southeastern Pennsylvania. More information is at www.ccedcpa.com. You can also view CCEDC’s interactive Annual Report at https://annual.ccedcpa.com/